With the closing of its latest mutual fund, Norrsken VC is taking an unprecedented step to tie partner compensation to the positive changes the company’s portfolio companies are making around the world – and not just to their financial returns.

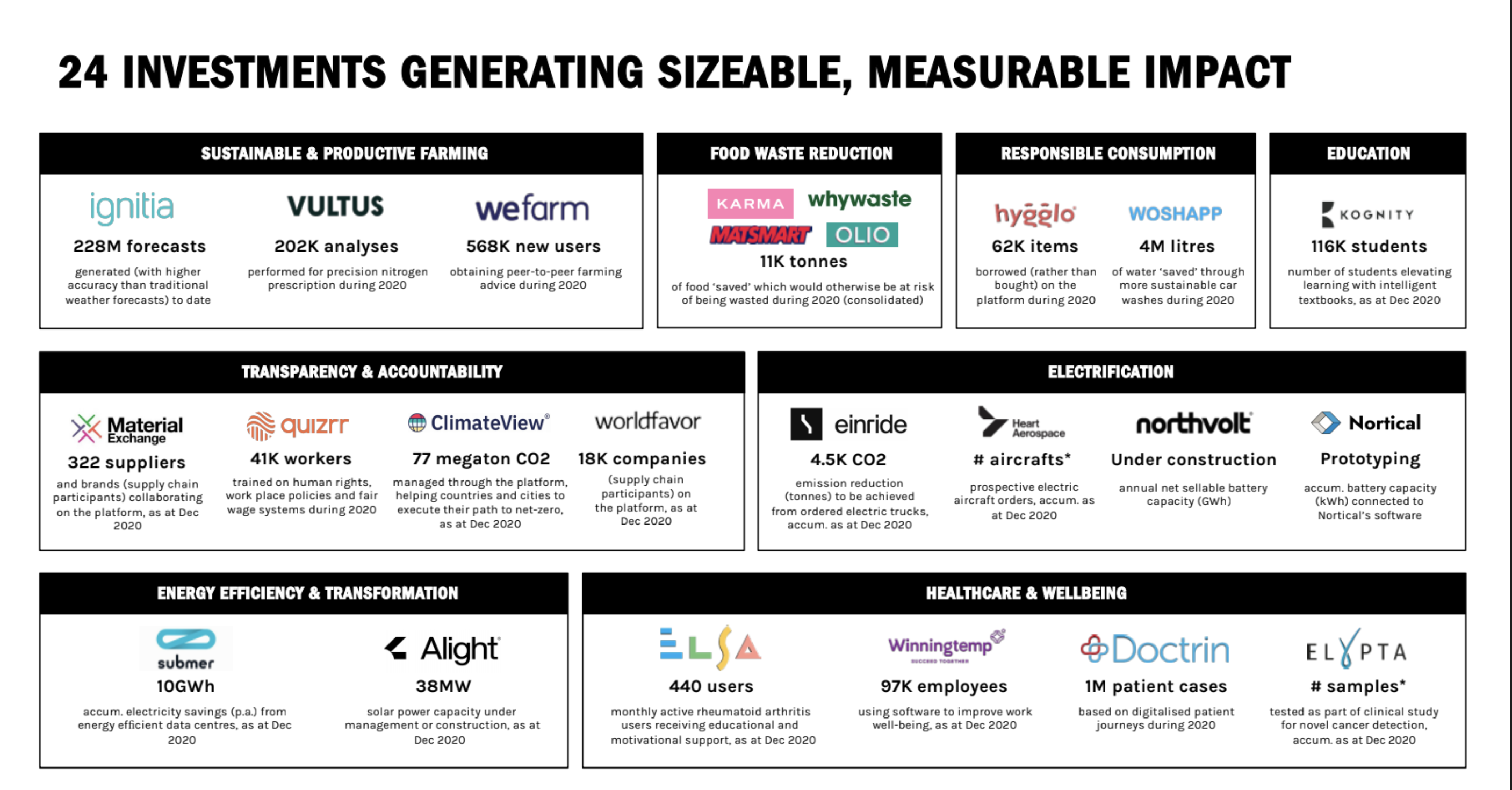

The company, which published its 2020 Impact Assessment last week, has invested in companies that meet seven of the United Nations’ seventeen Sustainable Development Goals and compares its performance with goals that range from strictly monitored to slightly tautological.

In some cases, the goals are just customer metrics (assuming that the more customers there are in a product, the better they are). To be fair, these are areas like education and healthcare where the real impact of a company’s services is harder to measure.

The company’s portfolio shows significantly more noticeable progress in the area of climate protection and sustainability. Avoided emissions or increases in energy efficiency can be measured quite easily here. And these energy efficiency gains and emissions reductions, as well as the lower waste associated with the company’s food and agtech businesses, is where the company performed at its best.

When they leave the company, this benefit will be of great importance to Norrsken’s partners as it will directly affect their compensation.

“For every investment we make, we set pre-investment targets that we want to see in terms of impact,” said Tove Larsson, General Partner of Norrsken VC. “We do this together with some of our key LPs in the fund. We need to get the approval of the advisory committee on the objectives. We set these goals for a single year and then on an annual basis. “

When the fund reaches the end of its cycle, the company reviews the aggregate result of all impact KPIs and weights the results of each company’s impact scores based on the amount we have invested in each company. On this basis, the company decides whether the team is interested or not.

If the portfolio companies achieve sixty percent of the goals set by the company and its advisory board members, they will receive half of the interest carried over and the remainder will be donated to charity. “There is a linear escalation of up to 100 percent. And if we fail to do that, the interest transferred will be paid to a charity or NGO, ”said Larsson.

Photo credit: Norrsken VC

Norrsken’s partners see their novel compensation structure as a point of differentiation, especially as the number of companies that focus on issues related to the United Nations’ sustainable development goals continues to grow dramatically.

“We started investing, we were one of the first – four years ago. Then the market has developed so quickly that we have questions about how you stand out from the crowd and how do you know if you are really an impact player, ”said Agate Freimane, General Partner of the company.

“This is a key part of DNA. We have to do better and show that we can hold the conversation, ”said Freimane. As a result, the company has taken a page from the European Investment Fund, whose operations impose similar compensation restrictions, she said. “When we heard about this approach, we said it makes 100 percent sense, and why don’t everyone do it?”

So far, the team has had no problems achieving the set goal. “We are at 119 percent of the 2020 targets,” said Freimane. Still, that’s only 12 percent of long-term goals. “Right now we’ve done a tenth of what we need to do over the life of the fund.”

While some of the goals may be … inaccurate … the steps the company’s portfolio companies have taken to reduce greenhouse gas emissions, food waste, and improve energy efficiency have a real, measurable impact. Whether this is reducing the energy consumption of data centers by 10 gigawatt hours thanks to the use of submer technologies; 11,000 tons of food waste reduced by operations in Karma, Whywaste, Matsmart or Olio; Saving 4 million liters of water from car washes with Woshapp; or the development of 38 megawatt solar projects thanks to the work of Alight.

Photo credit: Norrsken VC

“What we are most proud of is that we are actually doing this now,” said Larsson. “What we have now delivered is not perfect, but we really think we have to start somewhere and it is important that the industry becomes more transparent. The first thing we mentioned is that we consider it an achievement that we follow up and publish it. “