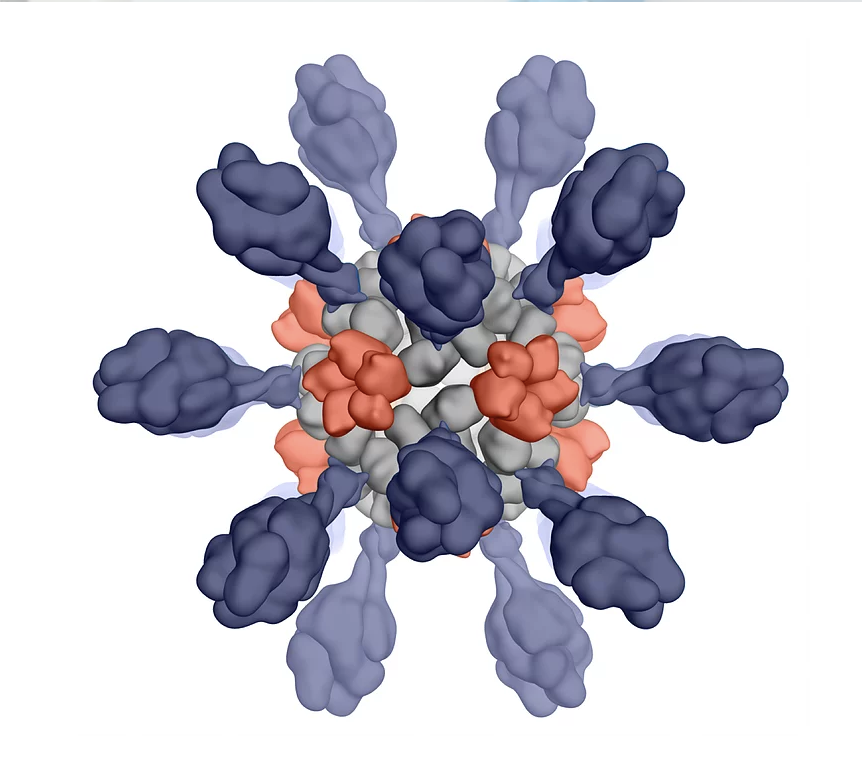

Icosavax creates virus-like particles using technology licensed from the University of Washington’s Institute for Protein Design. (Icosavax photo)

New financing: At a moment when everyone is talking about vaccines, a Seattle-based biotech company taking an unusual approach to vaccine production raised $ 100 million in a Series B round. The startup creates computerized, virus-like particles that are used in vaccines to trigger immune responses. The new funding follows a $ 51 million round in October 2019.

More about the vaccines: Icosavax is working on a COVID-19 vaccine as well as vaccines to prevent lesser known diseases: the respiratory syncytial virus (RSV) and the human metapneumovirus (hMPV). Early research shows that the vaccines produce strong immune responses.

“Based on preclinical data, we believe that our vaccine candidates could provide significant protection against leading viral causes of pneumonia in older adults for which no approved vaccines currently exist,” said Adam Simpson, CEO of Icosavax, on RSV and hMPV vaccines .

The company launched its COVID program in October, which was supported in part by the Bill & Melinda Gates Foundation with $ 10 million.

Strong connections to the Institute for Protein Design: The company is a spin-out from the Institute for Protein Design (IPD) at the University of Washington. The institute is led by David Baker, a co-founder and advisor to Icosavax. Icosavax’s virus-like particle technology was invented at the IPD by Neil King, who serves as chair of the startup’s scientific advisory board.

Simpson was formerly CEO of PvP Biologics, another IPD spinout that he oversaw from the company’s inception to its sale to pharmaceutical company Takeda.

Investors: The investment round was led by RA Capital Management and accompanied by Janus Henderson Investors, Perceptive Advisors, Viking Global Investors, Cormorant Asset Management, Omega Funds and Surveyor Capital. Others contributing to the round include existing investors Qiming Venture Partners USA; Adams Street Partners; Sanofi Ventures; and ND Capital. The round included cash from funding in October 2020.