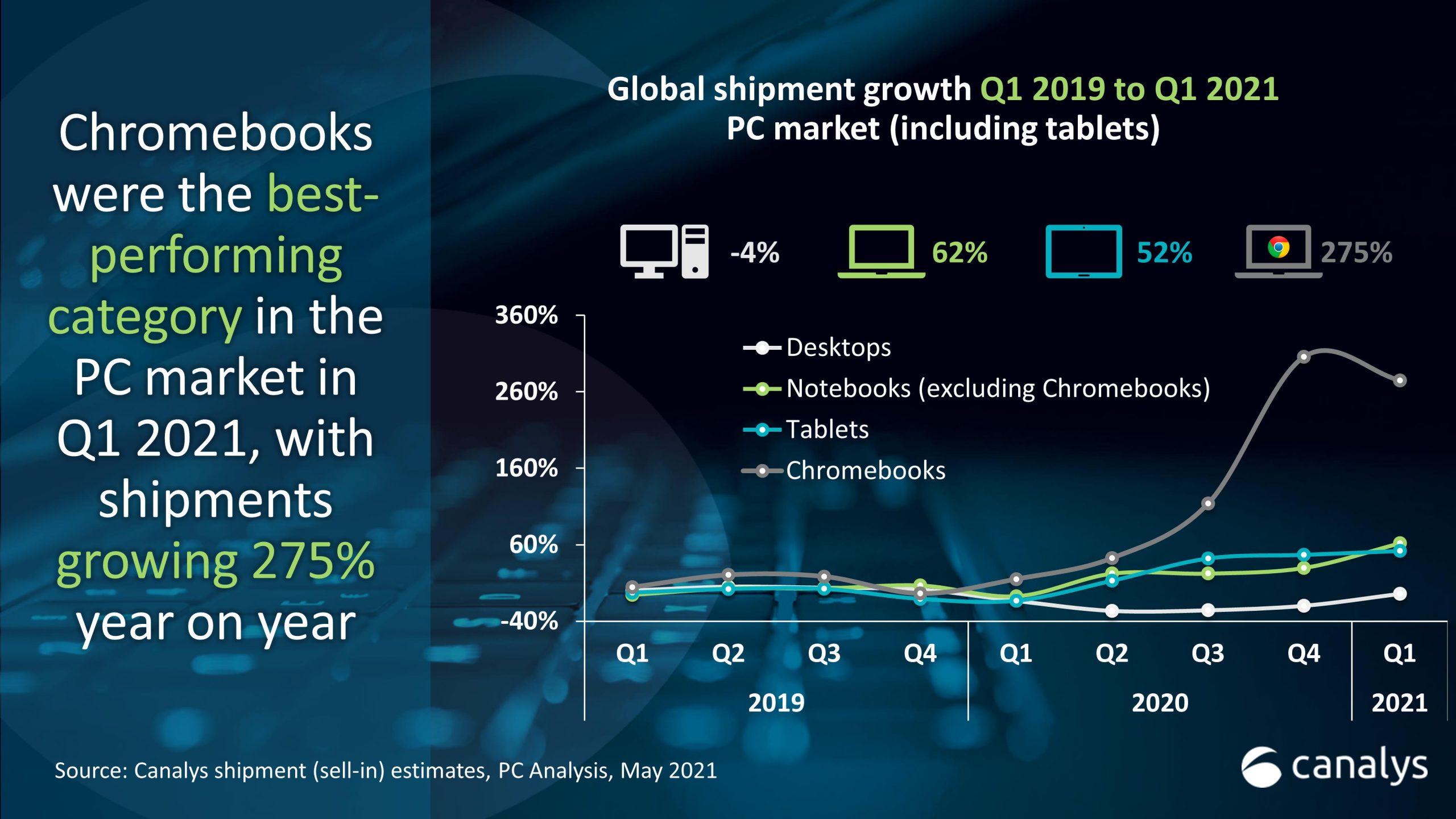

Everyone needed a new computer in 2020, and for a lot of people that ended up being a Chromebook. (Canalys map; click to enlarge)

Despite manufacturing bottlenecks, the global PC market grew for the fourth straight quarter. New system shipments rose 53.1% year over year to 122.1 million units in the first quarter, and Google’s Chromebooks saw a huge increase from 274.6% to 12 million units.

These data come from Singapore-based analyst firm Canalys, which released its latest report on the international PC market on Tuesday.

Worldwide PC sales have seen a boom since last year thanks to the widespread adoption of work-from-home and distance learning.

Chromebooks generally had record shipments in the first quarter of 2021, with HP, Lenovo, Acer, Samsung, and Dell being the top five vendors in the market. HP in particular accounts for 36.4% of the Chromebook market, which is almost double that of last year.

“While the education sector still makes up the bulk of it [Chromebook] Broadcasts, their popularity with consumers and traditional commercial customers have reached new heights over the past year, ”wrote Brian Lynch, research analyst at Canalys.

The Chromebook is generally seen as a low-power but affordable option that primarily uses web apps. This has made it a great choice for consumers who have had to switch to remote working at short notice. We’re also seeing some high-end Chromebooks for advanced users at prices that rival or exceed roughly equivalent Windows laptops.

Last year, Chromebooks sold Macs worldwide for the first time, reducing Windows’s market share.

Huawei effectively said goodbye to the market at the end of 2020 and Lenovo and Amazon closed the gap. (Canalys map; click to enlarge)

Huawei effectively said goodbye to the market at the end of 2020 and Lenovo and Amazon closed the gap. (Canalys map; click to enlarge)

Canalys also published figures from the tablet sector. Samsung, Lenovo, and Amazon all saw gains. At Amazon in particular, tablet shipments rose 197.9% over the past 12 months. Apple has slightly lost ground since last year, with 38.2% market share in 2021 versus 38.6% in Q1 2020, but it still ships almost twice as many tablets as its closest competitor.

“Even after the traditionally strong Christmas season, vendors see increased demand as the need for affordable computing power and connectivity persists,” said Himani Mukka, research analyst at Canalys. “At a time when the entire PC market is facing a supply crisis, vendors with strong tablet offerings have been able to capitalize on the increased demand for screen access and remote productivity caused by the pandemic.”

Huawei is losing to tablets, with Canalys recording a sharp 6% market share loss. This is due to Huawei’s decision in November to outsource the Honor brand to its own independent company following US sanctions.

In comparison, the desktop PC market has shrunk 4% over the past two years, although it saw a slight upturn over the course of 2020. It would be easy to attribute the drop in sales to the shortage of chips affecting electronics manufacturing worldwide since early last year – if supply can’t meet demand then demand is likely to decline – but Canalys estimates show that the downturn began in the fourth quarter of 2019.

While the Canalys report does not elaborate on this, sales of desktop PCs in general have been slowly declining for years.

Other analysts have attributed the move away from desktops to increasing growth in other parts of the computer market, such as cloud solutions and more powerful smartphones. A modern user doesn’t necessarily need a full desktop PC, especially given cheaper solutions like the Chromebook.