Today, June 10th, we recognize the efforts that this nation has yet to make to combat structural racism and disparities, including in the world of technology.

This week HBCUvc, a non-profit organization dedicated to diversifying the world of venture capital, launched a multi-million dollar fund. Founder Hadiyah Mujhid told me that the capital would provide non-dilutive funding to overlooked founders, who they define as black, indigenous and Latin American entrepreneurs, and would replace the traditional fishing round. But she also admitted that helping founders was not the only primary goal. Instead, she explained to me the meaning of what she defines as “teaching capital”.

Much like teaching hospitals offering budding physicians the chance to practice and learn their craft before officially entering the field, the fund aims to do so for its roughly 230 aspiring investors they already work with, many of whom are from historically black colleges and universities come from. In particular, non-dilutive capital provides entrepreneurs with no equity financing and a lower-stake learning experience.

There are currently many organizations that raise funds [with] the primary goal of supporting founders. And that’s a goal of ours, but we hope the training has a ripple effect and really provides ramps for the next best-in-class investors … and to do that they need to have a training vehicle.

While I’m not always a fan of renamed capital names, Capital Lessons is certainly a compelling setting. Track record is everything in this industry, and underrepresented people often do not have the benefit or privilege of access on their side – from the point of view of the dollar or the business. Scout programs have been around for a long time to fill this gap, but I think there is still a lack of intentionality in those who feel empowered to write an investment memo, ask questions, and be new. This week, BLCK VC launched its scout program and Google for Startups launched a non-dilutive financial instrument for black founders, underscoring the growing focus on attracting diverse entrepreneurs.

HBCUvc’s fund was announced almost a year after it nearly closed due to lack of capital. Mujhid explained how the unjust murder of George Floyd resulted in the largest one-day donation in her nonprofit’s lifetime that “changed the way that programming was done.” She also said keen interest was a knee-jerk reaction that prompted people to view this work as a long-term commitment.

We go into the rabbit hole of the creative capital:

In the rest of this newsletter, we’ll be covering Waymo’s latest raise, the Nubank EC-1, and a Pittsburgh event I can’t wait to see.

Waymo gets a lot more

Credit: Bryce Durbin

Waymo, Alphabet’s self-propelled arm, raised $ 2.5 billion in its second institutional round. Investors include Alphabet, Andreessen Horowitz, AutoNation, Canada Pension Plan Investment Board, Fidelity Management & Research Company, Temasek and of course Tiger Global.

Here’s what you should know: Waymo becomes external after some internal mixing. Funding comes just months after CEO John Krafcik stepped down from his title after five years in that position. Last month, Waymo lost its CFO and head of partnerships.

Here are my favorite summaries of the TC sessions: Mobility:

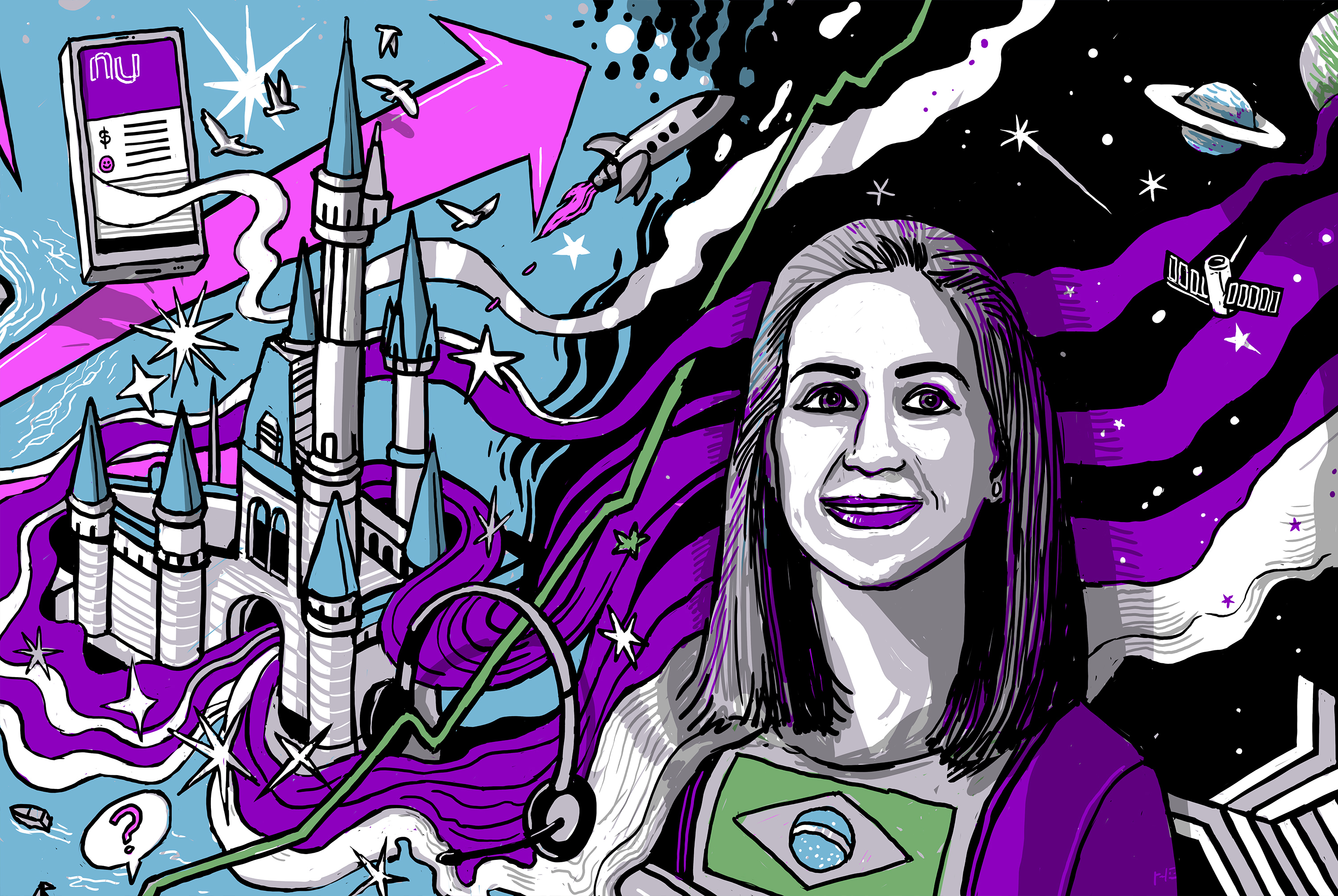

The Nubank EC-1

Credit: Nigel Sussman

Another week, another EC-1! Marcella McCarthy wrote about Nubank, a Brazilian credit card and banking fintech company that raised $ 30 billion worth of money just last week. With over 40 million users, it is one of the most valuable startups in the world.

Here’s what you should know: As McCarthy puts it in the piece, Nubank began by attempting to solve a massive challenge: “How to rebuild the concept of a bank in a country where banking is widely hated, while the incumbent incumbents heavily involved with the.” State rooted, working to block every step. ”Perhaps, the story goes on, it would start with California Street.

Check out each part of the following series:

All about TC

In May, thousands of you read my Duolingo EC-1, an in-depth look at Pittsburgh’s most popular edtech unicorn. Now we’re taking you to Pittsburgh to hear from Karin Tsai, head of engineering there, as well as Farnam Jahanian, president of Carnegie Mellon University, Mayor Bill Peduto and some local startups.

Our TC City Spotlight: Pittsburgh Event will take place on June 29th. So register here (for free) to listen to these conversations, enjoy the pitch-off and network with local talent.

Also a friendly reminder that we’re making a list of the best growth marketers for startups. You can help us by nominating your favorites for this survey.

Over the week

Seen on TechCrunch

Seen at Extra Crunch

Thanks for reading, as always. Take care of yourselves!

No