India could soon have another fintech unicorn. BharatPe said Thursday it raised $ 108 million in a round of funding that valued the New Delhi-based financial services startup at $ 900 million.

Coatue Management led the Series D round of the three-year startup. Another six existing institutional investors – Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo, and Sequoia Capital – also participated in the round, which has brought BharatPe a total of $ 233 million in equity and $ 35 million in debt to date.

As part of the new funding round, the startup announced that it had returned $ 17.17 million to its angel investors and employees with stock options.

“With the balance sheet well capitalized (more than $ 200 million in the bank) we will now keep our heads down and deliver $ 30 billion in TPV and a $ 700 million loan book with small traders by March 2023 build, “he said Ashneer Grover, co-founder and CEO of BharatPe.

BharatPe operates a service of the same name that helps offline merchants accept digital payments and secure working capital. Even though India has already become the second largest internet market with more than 600 million users, much of the country remains offline.

Among those that are beyond the reach of the internet are traders who run small businesses such as retailers. B. Roadside tea stalls and neighborhood shops. To make it easier for these merchants to accept digital payments, BharatPe is relying on QR codes and vending machines that support the government-sponsored UPI payment infrastructure.

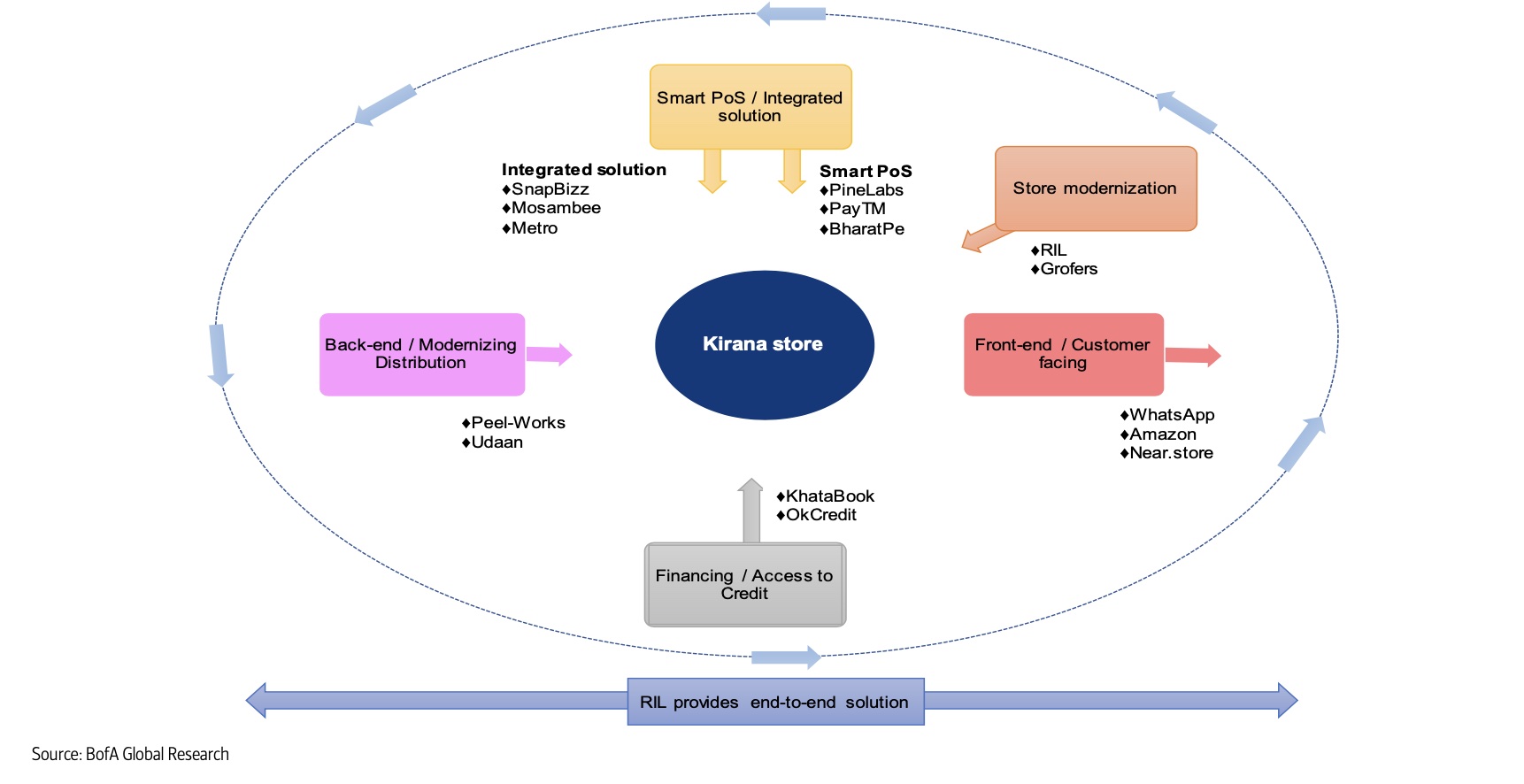

Numerous giants and startups are trying to serve convenience stores in India.

The startup said it had over 50,000 POS machines deployed by November last year and is enabling monthly transactions valued at more than $ 123 million. Merchants are not charged for universal access to QR codes, but want to earn money from lending. According to Grover, the startup’s lending business grew ten-fold in 2020.

“This growth reinforces the confidence that the small traders and kirana shopkeepers have shown in us. This is just the beginning of our journey and we are determined to build India’s largest B2B financial services company that can serve as a one-stop shop for small traders. For BharatPe, dealers will always be at the heart of our development, ”he said.

BharatPe’s growth is impressive, especially as it wasn’t the first startup to help traders. In a recent report to clients, Bank of America analysts said BharatPe had proven that fintech is not the winner of all markets.

“BharatPe may have the advantages of a late mover in space. It was one of the first companies to act as a universal consolidator of QR codes on UPI, giving the merchant the benefit of having a QR code (others like Paytm eventually followed suit). In contrast to its fintech colleagues, BharatPe does not train the dealers, but rather follows its larger colleagues who have already trained the dealers, ”they wrote in the report audited by TechCrunch.

The startup, which is now present in 75 cities, plans to further expand its national network with the new fund.