Jai Kisan, an Indian startup trying to bring financial services to rural India, where commercial banks have single-digit penetration, said Monday it had raised $ 30 million in a new round of funding to help scale its business.

Hundreds of millions of people in India now live in rural areas. Most of them have no credit score. The professions they work in – mostly agriculture – are not viewed as business by most of the lenders in India. These farmers and other professionals also do not have a documented credit rating, which puts them in a risk category for banks to give them a loan.

Much of the credit these people take out is ultimately invested in unproductive use, resulting in higher interest rates and default rates.

Three-year-old Jai Kisan, headquartered in Mumbai, seeks to solve this problem by treating farmers and other similar professionals as businesses rather than consumers.

The startup has developed its own system, which it calls Bharat Khata. It helps individuals and businesses get access to cheaper finance and ensures that the money they raise is used for farm supplies and equipment, as well as other income generating and rural commercial transactions.

Arjun Ahluwalia, co-founder and chief executive officer of Jai Kisan, said financial services are vital for these people as their entire economy depends on it. “The ability to buy now and pay later is the way most people in India shop. Credit is an expectation of the Indian customer – it’s not a value-added service, ”he told TechCrunch in an interview.

“When formal funding is available to customers, it’s not just the customer who is doing well. The whole ecosystem revolving around these customer benefits, ”he said, referring to the rise of Bajaj Finance, which has helped several companies thrive in India by lending customers at the time of purchase, as well as Xiaomi, India’s largest Smartphone vendor sells a large number of its devices to customers as part of monthly installment plans.

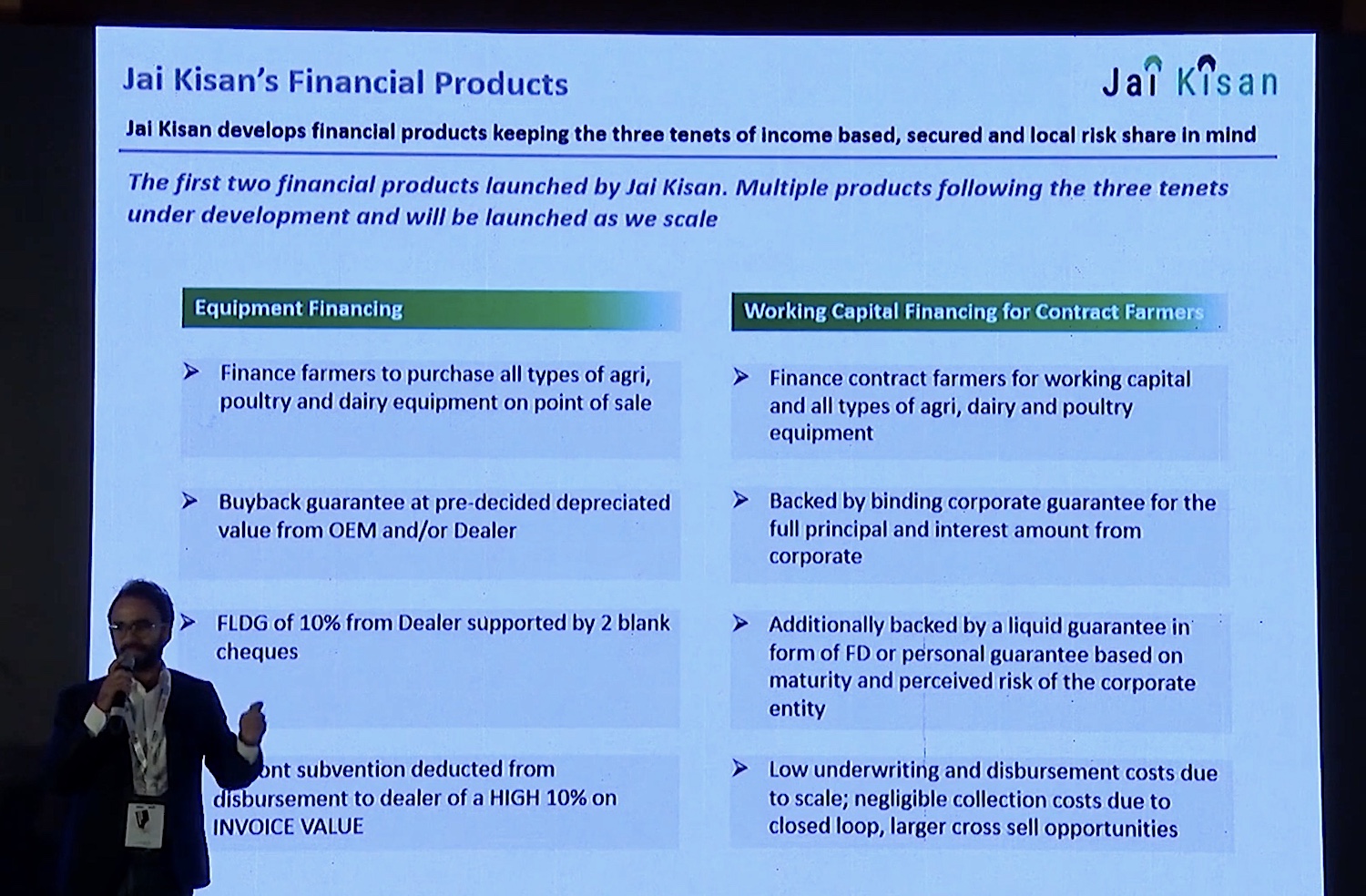

Ahluwalia at a conference in 2019 (India FinTech Forum)

The Bharat Khata service, which launched in April last year, had an annual GTV run rate of more than $ 380 million in over 25,000 stores by the fiscal year that ended in March of this year.

“Jai Kisan financed over 15% of the transactions, which shows the monetarizability and quality of the recorded trade. The ability to ensure transparency and virality of high quality transactions has enabled Jai Kisan to scale the business by over 50% in 3 months. The unprecedented growth trajectory is evidence of Jai Kisan’s ability to deploy capital efficiently by focusing on the core needs of customer credit, ”said the startup.

The startup, which operates in eight Indian states in southern India, is now trying to expand its presence across the country and increase the number of employees. On Monday, the company announced it had raised $ 30 million in a Series A round led by Mirae Asset, Syngenta Ventures and existing investors Blume, Arkam Ventures, NABVENTURES, Prophetic Ventures and Better Capital.

An unspecified amount of funding was raised as debt from Blacksoil, Stride Ventures and Trifecta Capital.

“Jai Kisan is on the verge of disrupting the rural finance industry and we are excited to be part of its growth story. Jai Kisan’s outstanding growth, asset quality and growing presence make it a highly differentiated player in this segment, ”said Ashish Dave, Managing Director of India Venture Investments for South Korean company Mirae Asset.

“Mirae Asset has always believed in helping companies aiming to become leaders in their category as a result of our other investments and we believe Jai Kisan is on the way to do so for rural finance to do, “he added.

Like most fintech startups, Jai Kisan has relied on his banks and other financial institutions to fund corporate loans. The startup said it will now self-finance 20% of all loans. For this reason, debts are also incurred in the new round.