Four months after a round of $ 30 million growth in Bibit, Sequoia Capital India has doubled its investment in the Indonesian robo-advisor app. Bibit announced today that it has led a new round of $ 65 million in growth, which included participation from Prosus Ventures, Tencent, Harvard Management Company, and returning investors AC Ventures and East Ventures.

This brings Bibit’s total funding to $ 110 million, including a Series A announced in May 2019. The final round will be used to develop and launch new products, and to discontinue and improve Bibit’s financial education services.

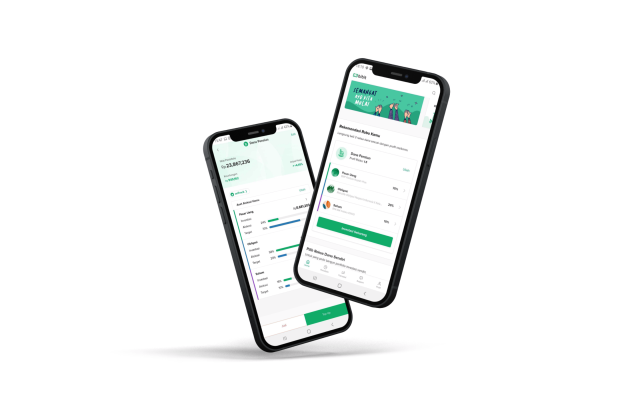

Launched in 2019 by Stockbit, a platform and community for equity investments, Bibit is part of a series of Indonesian investment apps aimed at new investors. Others are Ajaib, Bareksa, Pluang and FUNDtastic, which are supported by SoftBank Ventures. Bibit runs robo-advisor services for mutual funds, invests users’ money based on their risk profile, and claims that 90% of its users are millennials and first-time investors.

According to the Indonesian Financial Supervisory Authority (Otoritas Jasa Keuangan), the number of private investors increased by 56% in 2020 compared to the previous year. In the case of mutual funds in particular, the share of mutual funds increased by 78% year-on-year to 3.2 million, according to Bibit based on data from the Indonesian stock exchange and the Central Securities Custodian.

Despite the economic impact of COVID-19, interest in stock investing grew as people benefited from market slumps (the Jakara Composite Index fell in Q1 2020 but is now steadily recovering). Apps like Bibit and its competitors want to make capital investments more accessible with lower fees and minimum investment amounts than traditional brokers like Mandiri Sekuritas, which have also seen new retail investors and average transaction value increase over the past year.

However, the proportion of private investors in Indonesia is still very low, especially when compared to markets like Singapore or Malaysia, which offer growth opportunities for investment services.

Apps like Bibit focus on content that helps make capital investments less intimidating for first-time investors. For example, Ajaib also presents its financial literacy as a selling point.

In a press release, Sequoia Capital India Vice President Rohit Agarwal said: “Indonesian mutual fund clients have grown nearly ten times in the past five years. Mutual fund savings are the first step towards investing. Bibit has helped millions of consumers start their investment journey responsibly. Sequoia Capital India is excited to double the partnership as the company shares the same customer focus on equity investments with Stockbit. “