Another day, another deal.

Keeping up with the tide of acquisitions, IPOs, SPACs, and venture capital these days is no easy task. In fact, the IPO dollar volume for 2021 has already reached $ 171 billion, surpassing the record sums of last year. The same goes for mergers and acquisitions, with record levels of transaction activity seen for 2021.

Ben Gilbert, co-founder of Pioneer Square Labs and co-host of the Acquired podcast.

Ben Gilbert, co-founder of Pioneer Square Labs and co-host of the Acquired podcast.

The money will definitely flow.

Washington State now has 11 “unicorns” – privately held companies valued at $ 1 billion or more. Many of them – including Highspot, Zenoti, and Outreach – have raised venture capital rounds of $ 150 million or more in the past six months. And every day here at GeekWire, we update our funding list without blinking our eyes when a company announces new funding of $ 30 million, $ 40 million, or $ 50 million.

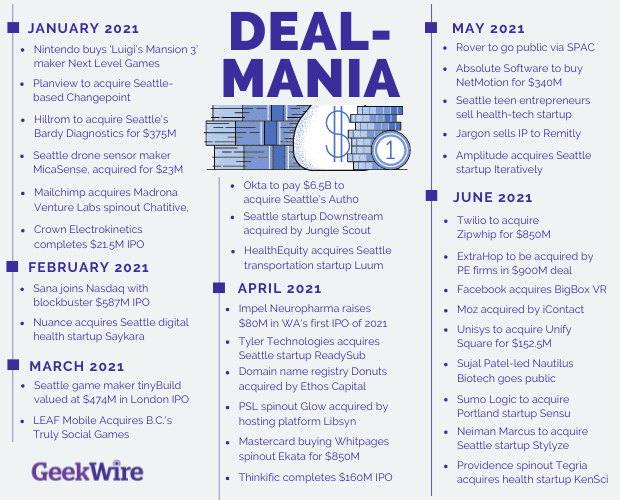

Additionally, we’ve tracked 33 IPOs, SPACs, and acquisitions of Pacific Northwest companies so far this year, including blockbusters like Okta’s $ 6.5 billion purchase of authentication ID startup Auth0 and Twilio’s $ 850 million. Dollar Acquisition of the business SMS startup Zipwhip. (The full list of offers can be found here).

To put the wild market in perspective, this week we starred on the GeekWire podcast by Ben Gilbert, a co-founder of Seattle venture capital company Pioneer Square Labs and co-host of the Acquired podcast, an in-depth show that discusses the ins and outs of Acquisitions and was recently ranked the number one tech show on Apple Podcasts.

Listen below, subscribe to any podcast app, and read on to see the highlights.

Here are some highlights from Gilbert’s remarks.

- About the Federal Reserve’s policy that triggers deal activity: “You can look at the supply-demand equation and find that when interest rates are low, it’s more attractive to invest in things like stocks.”

- Why this is a good time to start and sell a business: “On the financing side, you as a founder have more money than ever because people have found venture capital to be an asset class, or anything that touches tech companies, as a great place to invest.”

- Why acquisitions continue despite the threats of big tech company regulation: “I think tech companies have played a bit where they think, unless I’m doing something really obvious like Facebook, trying to go through another Instagram, make an offer for TikTok or something like that, it will I’m probably fine. “

- Why Tech Reviews Soar: “If you look at the average multiple of the turnover that a certain Software-as-a-Service company does in the public markets, it used to be 10-15. Now it’s 20-25…. And that’s in part being driven by the macro stuff we opened this up with, where people just say, ‘Hey, I believe in the future of these tech companies a lot more than some kind of old world industrial companies.’ Or maybe just, ‘Hey, I’ve got way too much cash. And that’s why I’m willing to pay more to own a technology stock because when I look at all the other stuff I could own, this seems to have the best future ahead of it. ‘”

- Deal activity predictions: “I think we will continue to see very big acquisitions…. With so many of these companies currently valued so highly, their market cap is, ‘Geez, we should be using our stock as the currency for something.’ We will continue to see a record rate of deals, and therefore a lot of stock deals. “

Podcast edited by Curt Milton; Music by Daniel LK Caldwell.