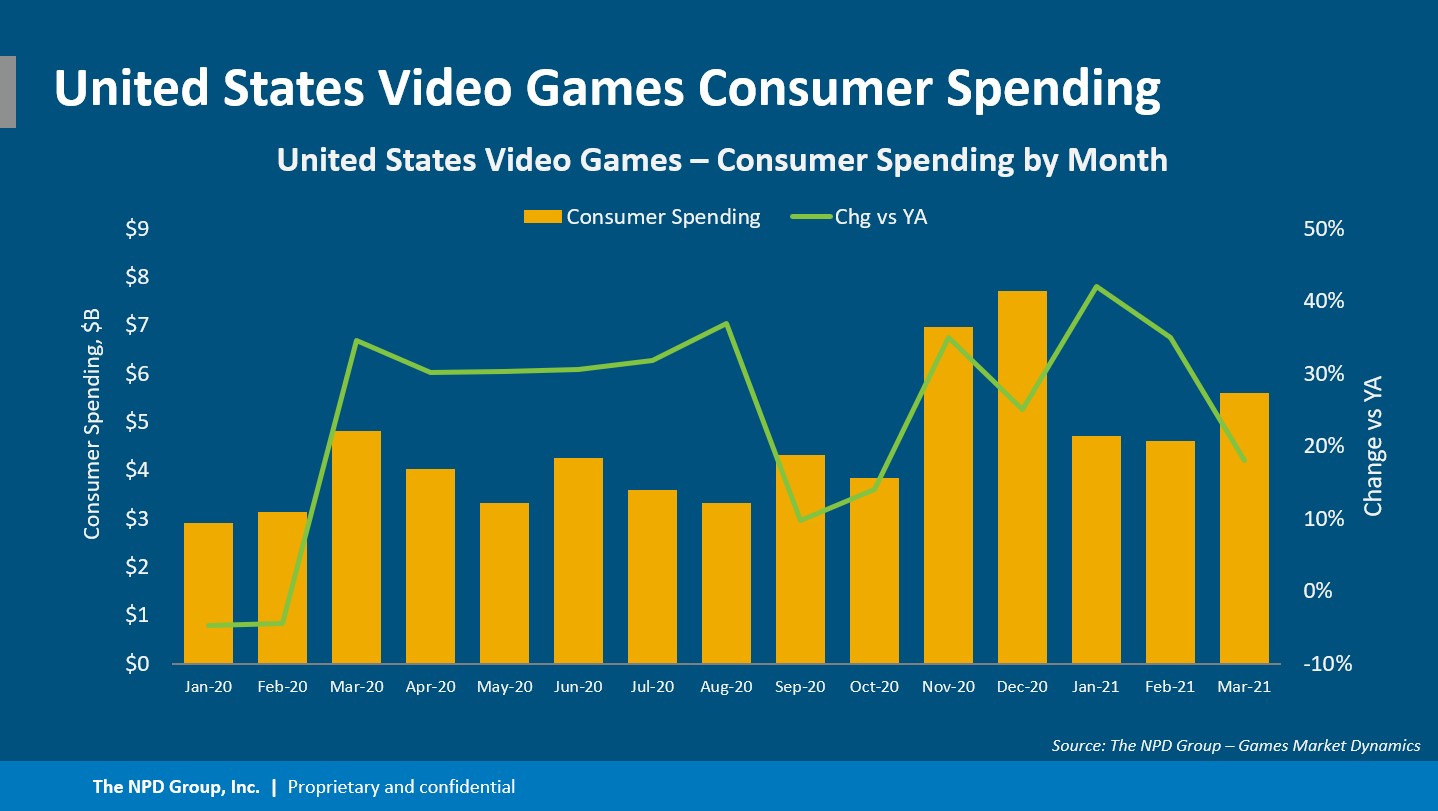

The first full year of the pandemic caused a significant surge in video game exposure that continues to this day. (NPD group diagram)

Last month, American consumers spent $ 5.6 billion on video game hardware, accessories, and miscellaneous content. This corresponds to an increase of 18% compared to March 2020 and a record for March every year.

The latest data from the NPD Group shows that year-to-date total video games were $ 14.9 billion, up 30% from Q1 2020. March was also the fifth straight month that total spending on the Video game consumers have set a record for monthly spending year over year.

This is also a milestone as we have a full year of data on how the COVID-19 pandemic has affected consumer habits. US game sales rose sharply in March 2020 and have continued a systematic, albeit inconsistent, surge since then, until they hit an all-time high in December.

Consumer interest in video games has rarely been higher, but the supply has rarely been lower. (NPD group diagram)

Consumer interest in video games has rarely been higher, but the supply has rarely been lower. (NPD group diagram)

We are also approaching an answer to the question of how the gaming industry will deal with it after the pandemic ends. You wouldn’t expect sales to be as hot as they are right now as many of the big games on the 2021 release calendar have been significantly delayed.

Work-from-home measures in 2020 had a significant impact on global game development, primarily due to the associated logistics. However, games are manufactured, manufactured, and shipped so far in advance that it creates a kind of statistical illusion. While other forms of entertainment were crippled or canceled by the pandemic, it was common for video games for most of 2020.

However, it has been long enough now that the effects of the pandemic are starting to show.

The PlayStation 5 and Xbox Series X | S continue to suffer from significant supply bottlenecks due to the international semiconductor shortage. Sony CEO Jim Ryan told the Washington Post in February that PS5 supplies are not expected to increase until the second half of this year.

Even so, according to the NPD figures this morning, the PS5 is officially the fastest-selling console in history. (Microsoft’s newest Xbox wasn’t covered by the data. However, shipments are still at least as limited as the PS5, suggesting it is about to sell too.)

Even with the slow creep towards the end of the pandemic and the easing of lockdown / distancing measures in the US, the demand for video games remains high.

That answers my big question I asked earlier this year about whether or not gaming can hold onto the newfound audience. Now the question is whether the industry can continue to meet this demand between the semiconductor shortages and the slowdown in game development.

So, despite the pandemic, growth is still happening. The lowest growth rate since an inventory was cleared in October. Mobile was responsible for most of the content growth, so the growth rate continued to decline. Or not. 2021. There is chaos, the demand is not normalized because of * everything *.

– Mat Piscatella (@MatPiscatella) April 16, 2021

My gut feeling is that a lot of bigger companies will be breaking into their back catalog before this is over. There were already plenty of remakes and remasters out of nowhere in 2021, like Square Enix’s SaGa Frontier Remastered earlier this week or the completely inexplicable return of Stubbs the Zombie from 2005 last month.

In the near future, Mass Effect: Legendary Edition will be released on May 14th, collecting and updating the science fiction trilogy for current generation hardware. the PC release of Sony’s open-world Pacific Northwest Zombies vs. Bikers game Days Gone on May 18; and a remaster of the cult hit JRPG Shin Megami Tensei III: Nocturne for Switch and PS4 on May 25th.

As for individual video game sales, the top ten of 2021 to date are largely dominated by last year’s hits, with the latest Call of Duty still comfortably on the chart. The two most recent entries, Capcom’s fantasy safari Monster Hunter Rise and Square Enix’s “looter shooter” Outriders, entered the annual list with a comfortable No. 4 and No. 10.

Square Enix and People Can Fly’s Outriders are the best-selling original IPs in 2021, but word of mouth could kill them in the end. (Enix square image)

Square Enix and People Can Fly’s Outriders are the best-selling original IPs in 2021, but word of mouth could kill them in the end. (Enix square image)

Outriders in particular are worth keeping an eye on. It showed an unusually solid performance for an original IP, peaking at number 3 on the NPD charts for March despite debuting on April 1st, but it will be interesting to see where it lands in the April top 10.

In particular, it will be a question of whether the initial hype from Outriders could survive the disastrous opening weekend. Outriders is an ambitious project on paper. It was simultaneously on PS4, PS5, Xbox One, X | Xbox Series S, PC and Stadia shipped and appeared on Xbox Game Pass on day one with the promise that players on all platforms could “cross-play” with each other.

The problem is, Outriders is an “always online” game too. Even if you are playing alone, Outriders will only work if you are constantly connected to the servers. The influx of new players at launch, thanks in particular to the Game Pass, meant that it was nearly impossible to connect and stay connected to Outriders for the first three days it was out. It’s the story of a game company that got a little too close to the sun. Outriders could have got away with staggered releases between platforms or their first day on Game Pass as an always-online game, but all three at once were a PR nightmare.

Mojang’s Minecraft is also experiencing a renaissance. While it’s the best-selling game in the world – you’d think there would be a point where anyone who wants Minecraft would already have it – it was the tenth best-selling video game in North America in March.

Mojang, a Microsoft company, recently announced that its next major Minecraft update, Caves & Cliffs, would be released in two parts. The first half will be released this summer. The update, which has been slowed down by COVID-related work-from-home measures, adds a lot of additional content to Minecraft, including new monsters, metals, biomes, and a revamped system for creating caves.