Many consumers use their credit cards to collect rewards for travel.

But what if you’re a sports fan and using your credit card could lead to a virtual conversation with a player on your favorite team? Thanks to San Francisco cardless, this opportunity may be less far than you think.

The startup, which aims to empower brands and tech companies to launch custom co-branded credit cards, has raised $ 40 million in a Series B funding round led by Activant Capital. Other investors include the owners and management of Phoenix Suns and Boston Celtics, as well as existing donors such as Accomplice and Pear VC. The funding brings the amount the two-year-old company has raised since it was founded in 2019 to $ 50 million. Complice and Greycroft jointly led the $ 7 million Series A last June.

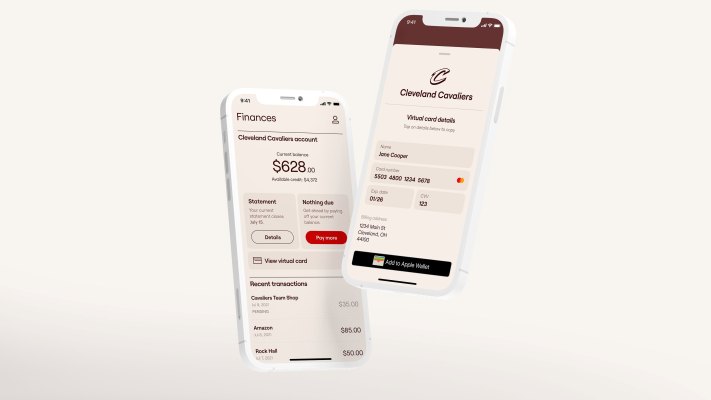

Put simply, cardless aims to Help consumer brands implement credit cards “very quickly and easily” by handling program creation, card underwriting, lending, issuing and customer service for brands. This quarter, the startup launched three digital programs – with the NBA’s Cleveland Cavaliers, British soccer team Manchester United, and the Miami Marlins, a Florida-based major league baseball team.

The company wants to modernize the entire concept of co-branded credit card programs. Of the 200 that exist in the US today, only one comes from a company that is less than two decades old, according to Cardless co-founder and President Michael Spelfogel.

“There are almost 200 brands with traditional cards, but they are often old-fashioned companies like Costco and Sam’s,” he told TechCrunch. “We want to connect people with the brands they love most and strengthen fan relationships with those brands.”

Cardless’ bespoke rewards programs are geared towards very specific demographics “who really appreciate the value of this brand,” added Spelfogel.

“Our first programs helped fans get things like player autographs and experiences that money can’t buy,” he said. The company plans to announce “several” more programs this year and says it can do so “in a matter of weeks” compared to traditional issuers, which can take months or more than a year to release similar programs.

These reward programs include digital apps and countless virtual cards.

Credit: Cardless; from left to right: Michael Spelfogel, co-founder and president; Scott Kazmierowicz, Co-Founder and CEO.

Cardless is trying to shake up a huge market. Consumer credit cards were worth an estimated $ 150 billion in revenue for traditional banks in 2019, but startups were only a tiny fraction of that value. Cardless aims to help brands and tech companies capture a larger slice of the huge market by partnering with a bank issuer to offer easy card issuance and bespoke digital credit programs to the customers of these brands.

“This funding round is the result, not the beginning of the long-awaited transition to digital card issuance,” said Scott Kazmierowicz, CEO of Cardless, in a written statement.

Cardless isn’t limited to working with sports brands.

“We strive to support the super users of today’s influential brands in a variety of industries,” said Spelfogel. “Cardless puts the customer first by eliminating fees and offering responsible products with transparent prices.”

Activant’s Andrew Steele was impressed with Cardless’ Ability to operate and implement “one-of-a-kind” credit card programs “for prestigious and innovative brands” just two years after launch.

“Most brands have been prevented from launching innovative credit card programs because of incumbent limitations,” he added. “It became clear that Cardless could transform and grow one of the largest markets for digital payments and that we are only at the beginning of what is possible.”