Wejo, the connected vehicle data startup supported by GM and Palantir, plans to go public through a merger with the special purpose venture acquisition company Virtuoso Acquisition Corp. that contains debt.

The deal brings Wejo $ 330 million in proceeds, including a cash stake from Virtuoso of $ 230 million and a private investment in public equity (PIPE) of $ 100 million. Former strategic investors Palantir and GM have anchored the transaction, according to Wejo. The company has not disclosed the amounts of these investments. According to the Investor Deck, the current shareholders retain 64% of the shares in the company.

Wejo will be listed on the Nasdaq public exchange once the transaction is completed, which is expected to occur in the third quarter.

Wejo works with automakers and tier 1 suppliers to collect real-time data from sensors integrated in vehicles. The company’s cloud platform aggregates and normalizes data and then shares those insights with customers. By 2030, Wejo estimates a connected vehicle data market at $ 500 billion and a serviceable addressable market of $ 61 billion, driven by projections of more than 600 million connected vehicles worldwide.

Wejo said the cash proceeds from the transaction will fully fund the five-year plan and help meet multiple growth goals such as engaging automakers and other OEMs faster, continuing to introduce services, and expanding into new markets.

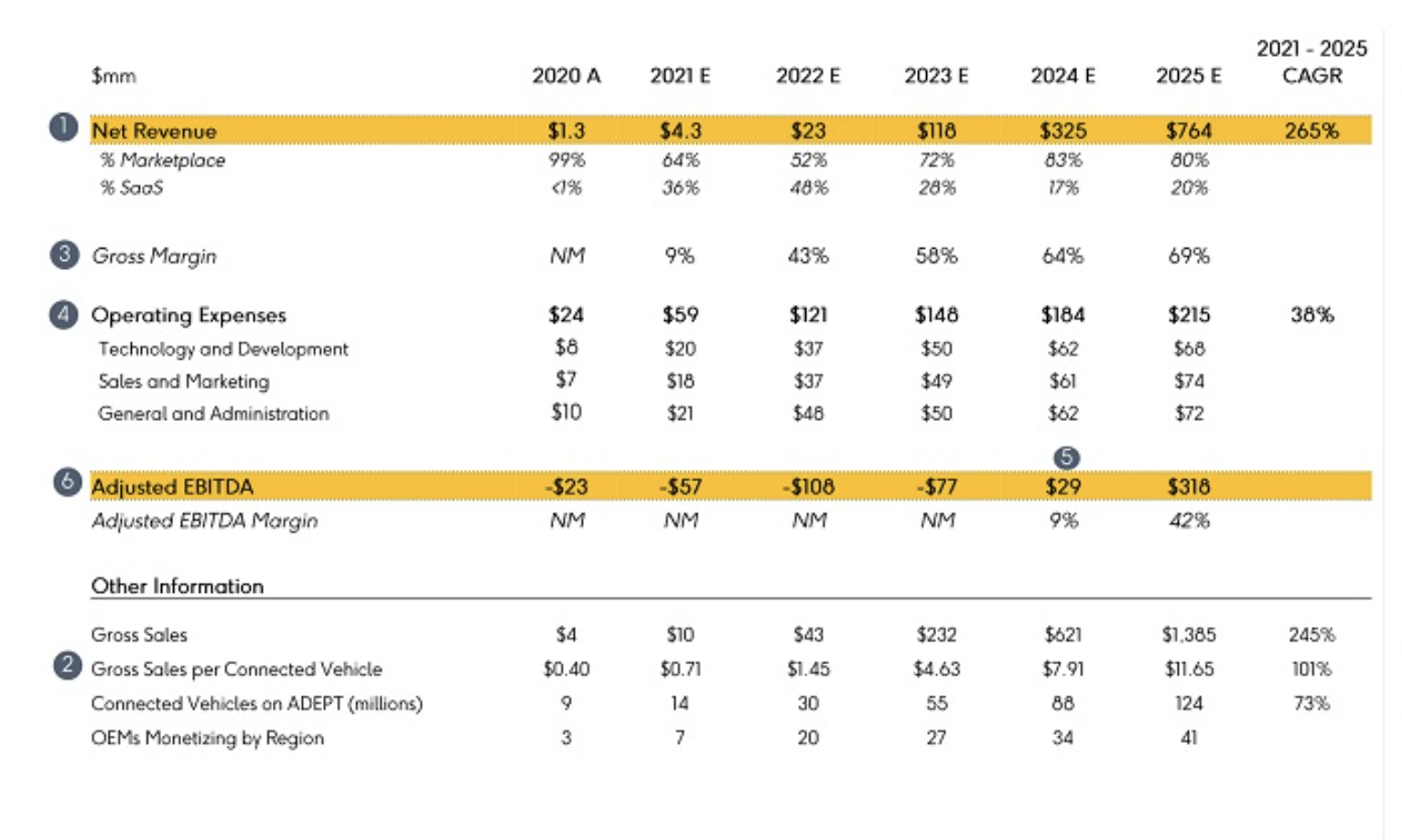

Credit: Screenshot / Wejo