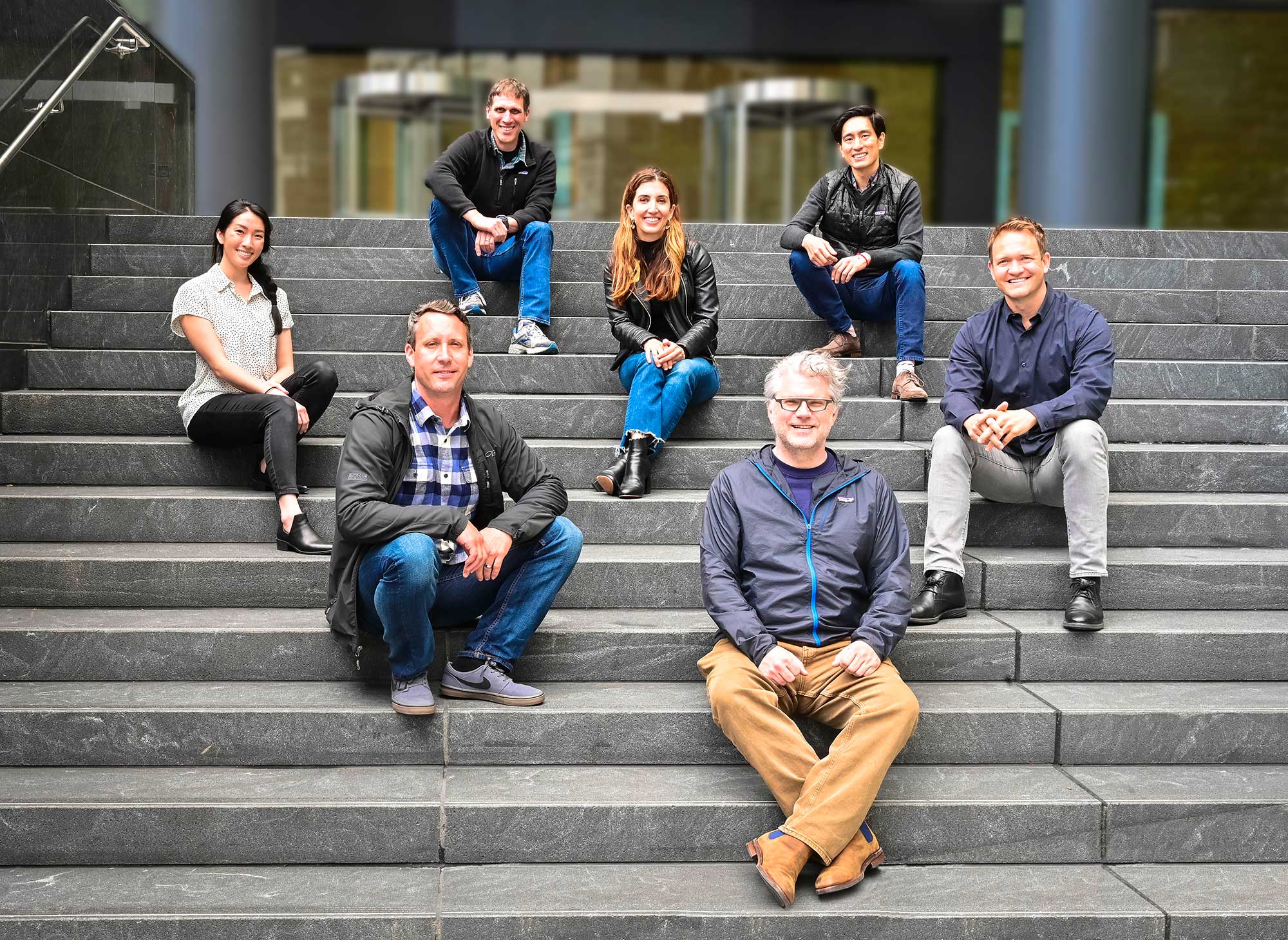

The Madrona Venture Labs team, clockwise from left: Flora Ku, Keith Rosema, Maria Hess, Henry Huang, Mike Fridgen, Jay Bartot, Jason Flateboe. (Madrona Venture Labs photo)

The news: Madrona Venture Labs, the startup studio affiliated with Madrona Venture Group, has raised $ 8 million for its fourth fund. The Seattle-based studio also unveiled a new model that will get its investors going – tech vets like former Zillow Group CEO Spencer Rascoff; former Qualtrics executive Julie Larson-Green; former Axiom CEO Elena Donio; etc. – in co-founders, board members and consultants of his startup spinouts.

MVL background: Founded by Madrona in 2014, the studio uses cash from its funds to brainstorm ideas and recruit a leadership team that will eventually run the business. The idea is to speed up the early start-up process for entrepreneurs. It has spun off more than a dozen companies, including some that were later acquired by Nordstrom, Uber, and Mailchimp. For the past 18 months, MVL has outsourced Zeitworks, Simplata and Stratify. Many other startup studios have started with different models in recent years, including Pioneer Square Labs, Kernel Labs, and Pienza in Seattle.

What’s new MVL aims to attract more talent to its studio by offering the opportunity to work side-by-side with investors in its funds. The strategy was based on the studio’s experience with Strike Graph and Stratify.

MVL managing director Mike Fridgen. (MVL photo)

MVL managing director Mike Fridgen. (MVL photo)

Hope Cochran, former CFO of King Digital and current Managing Director of Madrona, helped Strike Graph kick off a $ 3.9 million startup round from Madrona Venture Group. Steve Singh, former CEO and Managing Director of Concur at Madrona, used his personal experience with corporate finance processes to develop the idea for Stratify. Madrona also led a seeding round for Stratify; Singh’s former Docker colleague Brian Camposano is the startup’s CEO.

“If you think about what we did there with Steve who was involved in validation, co-founder recruitment and funding, remember to do it on a large scale across all of our businesses,” said MVL Managing Director Mike Fridgen. “That is the special thing.”

Too Much Equity? One criticism of startup studios is that they take too much stake in advance. This can discourage some business owners from keeping their shares.

In some cases, investors working with MVL spin-offs hold a stake, which could further dilute a founder’s stake. But Fridgen said the studio “isn’t really changing the economic terms with the founder”. He declined to give details of how much equity the studio needed.

“For the past five years we’ve been obsessed with increasing founder value and making the MVL model more beneficial than the bootstrapping model in terms of founder equity,” he said.

In a blog post, Fridgen explained the “most important improvements to our Founder Value Proposition”. This includes the “validation process”. “Founder’s Ownership;” – MVL has increased the founders’ shares over time – and access to finance. MVL uses its close relationship with Madrona as a selling point – it can help reduce the time it takes to set up a starting round.

Investors: Madrona is the main investor in MVL. Other participants in the fourth fund include seasoned tech managers such as Elie Seidman, former CEO of Tinder; Lorenzini Court, Co-Founder DocuSign; Elissa Fink, former CMO of Tableau; Erik Blachford, former CEO of Expedia; Mike McSherry, CEO of Xealth; Jon Gelsey, former Auth0 CEO; Chad Cohen, CFO of Adaptive Biotech; and Ralph Pascualy, former CEO of the Swedish Medical Group.

What’s next? The studio plans to outsource 6 to 8 companies with the new fund. It is focused on the Pacific Northwest but is open to working with businesses and founders based anywhere. The investment themes are AI-driven applications. Automation; and the future of work. MVL has raised $ 28 million to date.