Many Southeast Asian digital companies encounter early-stage obstacles when looking for growth finance. They may not want to sell equity in their business, but they often struggle to secure working capital loans from traditional financial institutions. This is where Singapore-based Jenfi comes in, offering revenue-based funding of up to $ 500,000 with flexible repayment plans that co-founder and CEO Jeffrey Liu calls “growth capital as a product.”

While revenue-based finance is gaining traction in many other markets, Liu told TechCrunch that Singapore-based Jenfi will be the first of its kind to focus on Southeast Asia. The startup announced today that it has raised $ 6.3 million in Series A led by Monk’s Hill Ventures. Attendees included Korea Investment Partners and Golden Equator Capital, 8VC, ICU Ventures, and Taurus Ventures. The company previously raised $ 25 million in debt from Arc Labs, based in San Francisco.

Jenfi works primarily with “digital-native” companies, including SaaS providers and e-commerce sellers. Some of its clients are Tier One Entertainment, Pay With Split, and Homebase. Jenfi has yet to reveal how much non-dilutive funding it has raised, but its goal is to raise $ 15 million by July 2022. It is alleged that the average Jenfi customer saw revenue growth of approximately 26.5% over three months, 60% over six months, and 156% over twelve months.

The total revenue of the companies in its portfolio is currently more than $ 30 million and Jenfi expects the capital already deployed to help them achieve revenue of $ 47 million, or a 156% increase, by July 2021.

Liu co-founded Jenfi with Justin Louie in 2019 after seeing traditional financial institutions lag behind Southeast Asia’s digital boom. The two previously founded GuavaPass, the gym membership platform that was acquired by ClassPass in 2019. Jenfi’s creation was motivated by some of the challenges Liu and Louie faced in financing a high-growth startup focused on Asian markets.

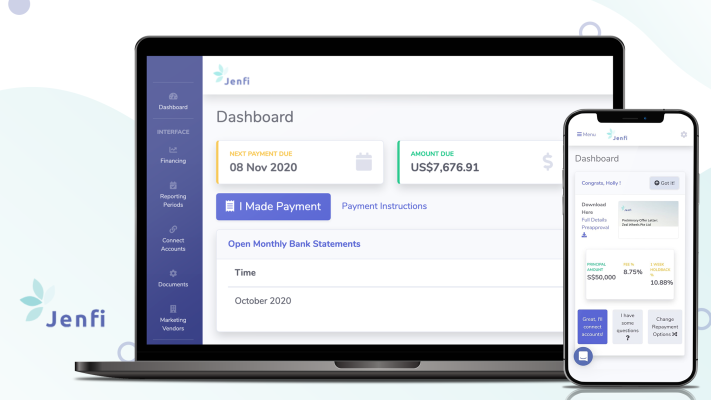

Jenfi’s application process is entirely online and in some cases companies have received funding in less than 24 hours, although it typically takes a few days. This is another advantage over traditional working capital loans or private equity financing, which can take months to close, making it difficult for companies to respond quickly to revenue growth opportunities. For example, an e-commerce company may need quick working capital to buy more inventory when suddenly there is a high demand for a particular product.

Part of Jenfi’s Series A is also being used to develop further integrations for its proprietary risk assessment engine, which analyzes how efficiently companies are using their growth spending. Currently it can get information from bank accounts; Software like Xero or Quickbooks; Payment gateways including Stripe and Braintree; Ecommerce platforms like Shopify, Shopee, and Lazada; and Facebook Ads and Google Ads.

Instead of fixed installment repayment plans, Jenfi offers companies more flexible target repayment plans and charges them a flat fee based on the amount of funding received, their monthly sales and the repayment of the loan. Jenfi continues to analyze the data sources provided by companies to determine if a customer may need more capital or an adjustment to their repayment terms.

Ultimately, Jenfi plans to go beyond funding and also provide tools to help businesses. “We see ourselves as partners in the growth of our portfolio companies,” said Liu.

Because Jenfi uses a mix of data sources – including bank accounts, accounting software, and digital advertising platforms – it can use the same information to identify opportunities. A portion of Jenfi’s Series A funding will be used to develop automated analytics. For example, the platform would be able to identify a high ROI advertising opportunity on Google Ads and notify the company if it wants to raise more capital to fund the campaign.