Investors are backing Koo, an Indian alternative to Twitter, with extensive checks at a time when tensions are building between the American social network and New Delhi.

The Indian startup announced on Wednesday that it had raised $ 30 million in a funding round led by Tiger Global Management. Mirae Asset, IIFL’s venture capital fund, and existing investors 3one4 Capital, Blume Ventures, and Accel also took part in the round that valued the Bangalore-based startup at over $ 100 million, down from around $ 25 million in February.

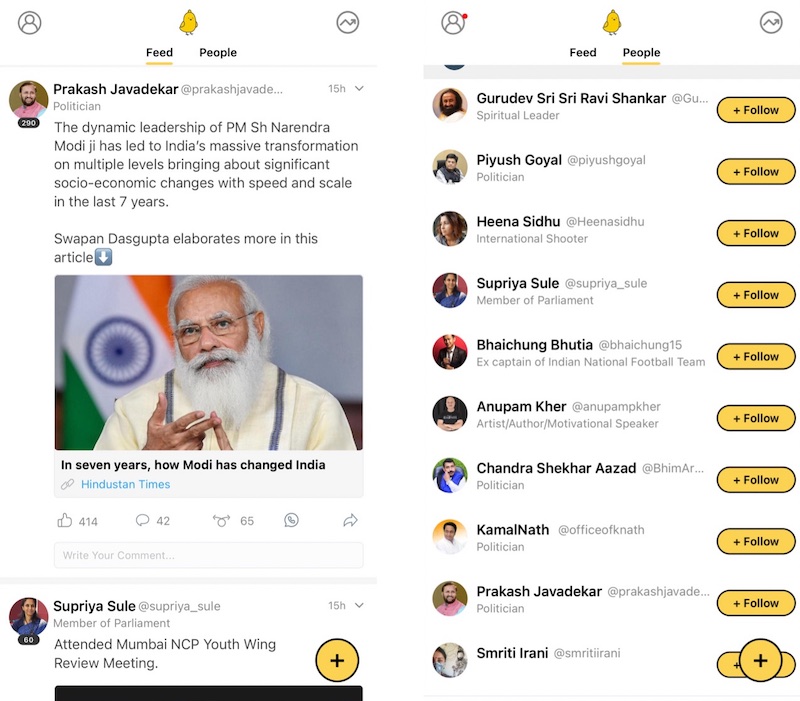

As with Twitter, the Koo app allows users to post in English and a half-dozen Indian languages. The app has grown in popularity in India in recent months after Twitter and the Indian government flared up after the San Francisco-based company refused to suspend accounts criticized by New Delhi and Prime Minister Narendra Modi earlier this year.

(The Indian government, like Singapore’s last week, ordered Twitter and Facebook to remove posts that identified a new variant of the coronavirus as “Indian variant.” Also last week, New Delhi refused to flag some of its politicians’ tweets Twitter from earlier this week, Delhi police visited Twitter offices to “deliver a notification.”)

Several prominent government officials – including Commerce Minister Piyush Goyal, Information and Broadcasting Minister Prakash Javadekar, Union Cabinet Minister Smriti Irani, Electronics and IT Minister Ravi Shankar Prasad – and many celebrities have signed up with Koo in recent months and urged their supporters to join Example to follow.

Although the app, which was co-founded by Aprameya Radhakrishna (who also co-founded TaxiForSure, which was sold to local giant Ola and is a prolific angel investor) has won investor trust, it has yet to gain ground.

The Koo app, which launched last year, had fewer than 6 million monthly active users in India as of April, according to App Annie, a mobile insights company (data shared by an industry executive with TechCrunch).

The startup wants to build a social network for the entire nation and not just a fraction of it. Twitter remains largely popular with users in urban cities in India.

Koo, whose initial traction was attributed to Hindu nationalists, is currently one of the few social networks to have followed India’s new IT rules, which give New Delhi more power to cut posts it deems objectionable.

The revised IT rules announced in February would put an end to the “double standard” by making platforms more accountable to local laws, government officials said at the time. Failure to do so can result in social networks losing the protection of the safe haven they enjoy.

The deadline for compliance with the new rules expires on Wednesday. Facebook, which identifies India as its largest market, said it wants to “abide by the new rules” while Google said in a statement that it “respects” India’s legislative process.

Koo is Tiger Global’s latest investment in India this year. The hedge fund, which has supported over 20 Indian unicorns, has become the most productive investor in Indian startups in recent months and has won over the founders with its investment speed, check size and favorable terms.